Automated Crypto and

Stock Trading

Generate Passive Profits Today

Activate Any

Crypto or Stock On

Major Exchanges

Automated Sell Trades

When Prices Go Up

Automated Buy Trades

When Prices Go Down

Simple, Powerful Algorithmic Trading Strategy

Track Your Profits

No Credit Card Required to Use KryptoScalper

Sign Up and Try KryptoScalper Free for 30 Days!

Introductory Video

About KryptoScalper

KryptoScalper is an exciting, new application that empowers you to carry out from your computer, automated cryptocurrency trading 24/7 through your existing cryptocurrency exchange account AND automated stock trading using API keys. The moment you link the app to your cryptocurrency and/or brokerage account and turn it on, KryptoScalper automatically starts selling small portions of your cryptocurrencies/stocks when prices go up and buys them back when prices go down, all without having to click on anything! The KryptoScalper app does it all for you enabling you to compete with professional traders! It uses a trading algorithm strategy that lets you capitalize on the up and down price swings from the cryptocurrencies/stocks you own. KryptoScalper is intended for people who already own cryptocurrencies and/or stocks and would like to generate trading profits while holding on to them.

For US stocks daytrading, please be aware of FINRA's Pattern Day Trader minimum equity requirement of $25,000.

Trading Algorithm Strategy

Using a simple price volatility trading strategy, KryptoScalper sells a small portion of your cryptocurrencies/stocks when prices go up and buys back a small portion when prices go down. The repetitive, “selling high and buying low”, adds discipline to your financial trading and gives you the potential to actively accumulate extra amounts of coins/shares and cash while prices are swinging up and down, instead of just staying on the sidelines as a spectator. KryptoScalper uses a combination of incremental price scalping levels and the quantity of your cryptocurrency/stock holdings to determine the price and quantity it will execute the trades at. With every price level increase, KryptoScalper will sell less and less of your cryptocurrency/stock in order to ensure you never run out of it and with every price level decrease, KryptoScalper buys more and more of your cryptocurrency/stock so you can accumulate extra coins/shares.

Profit Potential

The higher the volatility, the higher the trading profits. Defining a round-trip trade as a sell trade and a buy trade, cryptocurrency coins that executes a daily average of 5 round-trip trades can make a trading profit of 27.5% on an annual basis or 2.3% on a monthly basis.

In 2021, Bitcoin (BTC) and Ethereum (ETH) have been some of the least volatile coins when compared to others where on average 4 and 6.25 round-trip trades were executed on a daily basis, respectively. That means if you had used KryptoScalper on Bitcoin and Ethereum, every $10,000 invested would have made you gross, $2,200 on Bitcoin and $3,435 on Ethereum for 2021. During the same period, Cardano (ADA) and Harmony (ONE) have been some of the more volatile coins, executing 10 and 14 round-trip trades on a daily basis, respectively. This would have made you $5,500 and $7,700 gross profits for every $10,000 invested.

PAST VOLATILITY OR PAST PERFORMANCE IS NOT AN INDICATOR OF FUTURE VOLATILITY OR FUTURE PERFORMANCE. TRADE AT YOUR OWN RISK.

Price/Quantity Rules and Ratio

Grab your calculator for this section. The incremental price levels are set at 1.5%, so when a round-trip trade of a buy and a sell occurs, you are usually able to make a net profit of about 0.9% after all trading commission fees are deducted. The high frequency trading strategy of KryptoScalper relies on using exchanges that charge low commissions, ideally below 0.20% for each trade. KryptoScalper charges 0.10% for each trade. So under normal trading circumstances, when carrying a round-trip buy and sell trade at 1.5% gross profit and then subtracting 0.20% commission from the exchange for each buy and sell trade and then subtracting 0.10% commission from KryptoScalper for each buy and sell trade you are left with a net profit of 0.90% (1.5% - 0.20% - 0.20% - 0.10% - 0.10% = 0.90%), plus any surplus achieved when limit orders are filled at a better price. Of course, if your account has any kind of a premium trading status with the exchange and/or if you enable the exchange’s trading token to be used for paying commissions, then the exchange's commission rate would be lower. For example, Binance’s spot trading fees are typically 0.10% (subject to constant change). If you use their BNB token to pay for commissions, it then drops to 0.075%. So, if you have BNB tokens enabled for paying trade fees, your round-trip net profits on Binance when using KryptoScalper would normally be at least 1.15%. Alpaca and Tradier currently charge 0% commission on stock trades.

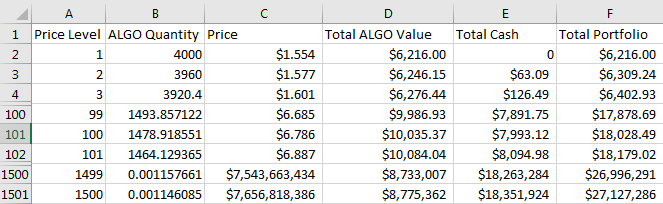

The initial and decremental trading quantities are set at 1% so you never run out of your cryptocurrency/stock, even if it goes to $1 million dollars a coin/share! Using a spreadsheet, let’s look at a hypothetical example to better explain what happens when a coin goes straight up and never comes back down.

This spreadsheet shows an account with 4,000 ALGO coins with a starting value of $1.554 totaling $6,216 in value and no cash in row 2. When the price goes up 1.5% to $1.577 in row 3, KryptoScalper will sell 1% of the coins, 40, leaving it with 3,960 ALGO coins that are now valued at $6,246 with $63.09 cash. There are less coins, but with a higher total value. When the price goes up again in row 4, it will sell 1% less than previously before, 39.6 coins, leaving the account with 3,920.4 coins valued at $6,276 with now $126.49. If we continue the trend 96 more times, we see that in row 100 at the 99th price level, there will be 1,493.85 ALGO coins remaining in the account, valued at $9,986.93 with $7891.75 cash. If we continue the trend 1400 more times, there will be 0.001157661 ALGO coins left in the account, valued at $8,733,007 with $18,263,284 cash! As you can see, even though the quantity of ALGO coins approaches 0 as the price goes to the moon, it never runs out and its total value in the account keeps going up.

This spreadsheet shows an account with 4,000 ALGO coins with a starting value of $1.554 totaling $6,216 in value and no cash in row 2. When the price goes up 1.5% to $1.577 in row 3, KryptoScalper will sell 1% of the coins, 40, leaving it with 3,960 ALGO coins that are now valued at $6,246 with $63.09 cash. There are less coins, but with a higher total value. When the price goes up again in row 4, it will sell 1% less than previously before, 39.6 coins, leaving the account with 3,920.4 coins valued at $6,276 with now $126.49. If we continue the trend 96 more times, we see that in row 100 at the 99th price level, there will be 1,493.85 ALGO coins remaining in the account, valued at $9,986.93 with $7891.75 cash. If we continue the trend 1400 more times, there will be 0.001157661 ALGO coins left in the account, valued at $8,733,007 with $18,263,284 cash! As you can see, even though the quantity of ALGO coins approaches 0 as the price goes to the moon, it never runs out and its total value in the account keeps going up.

Math Formula

KryptoScalper sets every price scalping level increase at 1.5% price increments and every quantity scalping level increase at 1% decrements. The starting price scalping level will be set by you and the initial trading quantity is set at 1% of your cryptocurrency/stock holdings that you choose to activate. When the price of your cryptocurrency/stock goes up 1.5%, KryptoScalper will sell about 1% of your activated holdings. The next trading rule will be to either 1) sell another 1% of your activated holdings if the price goes up another 1.5% or to 2) buy an additional 1% (plus a little extra) of your activated holdings if the price goes down 1.5%.

KryptoScalper in Action

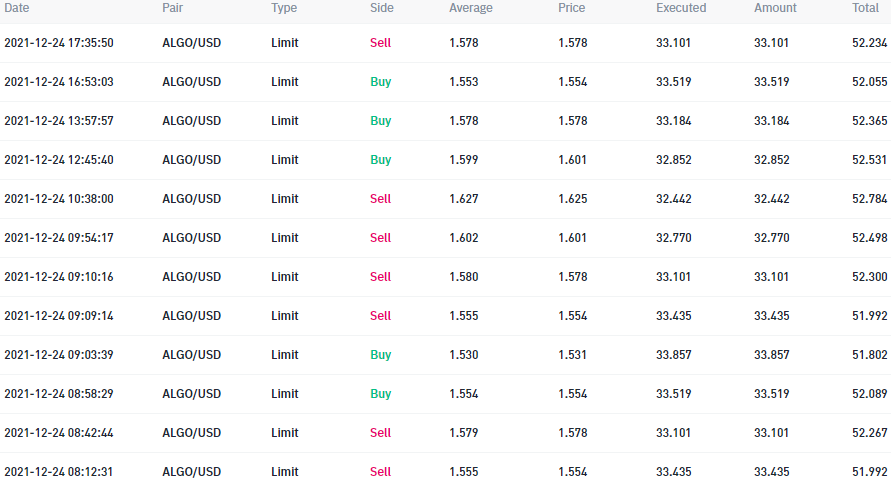

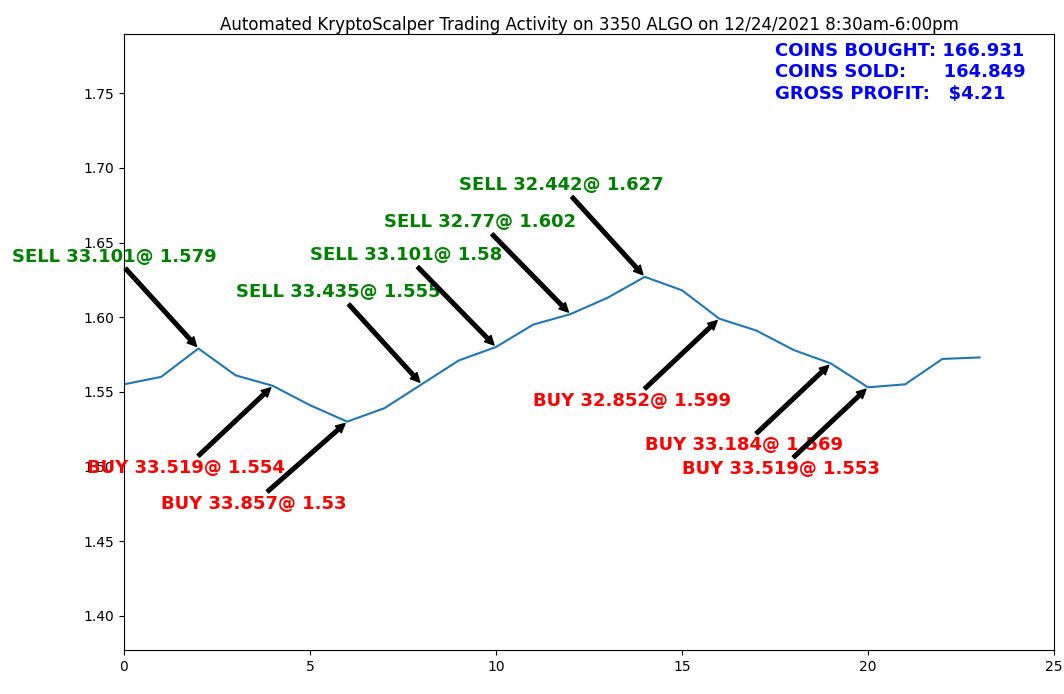

We’ll use a picture to better explain how KryptoScalper works. Below is a snapshot of the recent trading history of Algorand on Binance US. All of these trades were executed by KryptoScalper. This account has 4,000 ALGO coins, but has activated 3,350 coins for scalp trading. The term “activated”, represents the portion of the cryptocurrency holding that you want KryptoScalper to include in its trading algorithm and the remaining portion will be excluded.

Let’s look at the first trade below, executed on 12/24 at 8:12:31 am.

1) KryptoScalper submitted a limit sell order to sell 33.435 ALGO coins at $1.554 for a total of $51.992. The price of ALGO then went up.

2) KryptoScalper then sold another 33.101 coins (1% less than before, 33.435 * 0.99) at $1.578 (1.5% more than before, $1.554 * 1.015) for a total of $52.267. The price of ALGO then dropped.

3) KryptoScalper then bought 33.519 coins (1.25% more than before, 33.101 * 1.0125) at $1.554 for a total of $52.089. The price of ALGO then dropped.

4) KryptoScalper then bought 33.857 coins (1.25% more than before, 33.435 *1.0125) at $1.531 for a total of $51.802. This trade was executed at 9:03:39 am.

To summarize, in the first 2 trades 66.536 ALGO coins were sold for a total of $104.26 In the next 2 trades, 67.376 ALGO coins were bought back for a total of $103.89. Using KryptoScalper’s price volatility trading, we were able to accumulate an extra 0.84 ALGO coins and $0.37 cash.

Scalping Fees

KryptoScalper is free the first 30 days! After that you'll be billed 0.10% commission for each buy or sell trade when the trial period is over. However, since KryptoScalper utilizes a strategy of only submitting limit orders (not market), it usually fills trades at better price points than the limit price which offset some or all of the trading fee. The greater the volatility, the higher the offset. In the previous example shown, the 12 buy and sell trades of ALGO shown in the picture above shows that the trades were executed at a better price on average by 0.063%, making the net trading costs of using KryptoScalper only 0.037%. During periods of high volatility in the past, the KryptoScalper application has executed trades at a better price by over a full 1% than the submitted limit price.

Risks of Using KryptoScalper

In addition to the risks of owning and trading cryptocurrencies on centralized exchanges (stock brokerage accounts on Alpaca and Tradier are SIPC-Insured), there are two additional risks when specifically using KryptoScalper and they both have to do more with the trading strategy than the app itself. The first one is the risk of foregone profits. Since KryptoScalper sells as the price goes up, you end up forfeiting any future gains you might have had when you sell any of your coins/shares. In the spreadsheet example of Algorand, if the price shoots straight up to $6.68, KryptoScalper will have sold about 2,500 of the 4,000 coins leaving you with a total account value of $17,878. If you had not sold any of your coins in the first place, then your account would have a total value of $26,740. This example represents $8,862 of foregone profits.

The second primary risk of using KryptoScalper, is the risk of buying too much of a coin/stock if the price crashes. Since the app will continue to buy more and more of a coin/stock as the price goes down, you may end up buying much more of a coin/stock than you had originally planned on as well as running out of cash (or other any other currency you use for purchasing, such as USDT/BTC) in your account. This risk is mitigated with the configuration file where you can instruct KryptoScalper what the lowest cutoff price is for not executing any more buy trades for each coin/stock. You can also instruct KryptoScalper not to execute any buy trades for any coin/stock if your account drops below a certain amount of cash, or whatever currency you use to buy. These controls together help maintain the financial health of your trading account when prices are crashing.

Supported Exchanges

KryptoScalper does not recommend or attest to any cryptocurrency exchange platform. It is your responsibility to do your own due diligence before opening an account with any cryptocurrency exchange. At this time, the KryptoScalper application supports API Trading on Binance, Binance US, KuCoin, CoinbasePro, OKX, Gate.io, Huobi, Kraken, Bittrex, Bitstamp, Tradier, and Alpaca (Stocks Only). These platforms were chosen, because their trading commission fees are low (an absolute must for high-frequency trading), they enable API trading, and on average provide good liquidity to traders in most trading pair markets.

Prerequisites For KryptoScalper

You will need the following to use the KryptoScalper application:

1) A Windows (7 or higher), Mac, or Linux computer (Preferably a desktop, since this is an app that you’ll want to run 24/7)

2) An account on one of the supported platforms: Alpaca (Stocks Only), Binance, KuCoin, CoinbasePro, OKX, Gate.io, Huobi, Kraken, Bittrex, Bitstamp, or Tradier.

3) API keys and API trading enabled on your cryptocurrency exchange account

4) Cryptocurrency coins or stocks to trade

5) A registered KryptoScalper account with a license key

6) The KryptoScalper software

Support

Have questions or need assistance? Feel free to reach out to us at: info@kryptoscalper.com

Cryptocurrency Risk Disclosure: Cryptocurrency is highly speculative in nature, involves a high degree of risk, such as volatile market price swings, market manipulation, flash crashes, and cybersecurity risks. Cryptocurrency is not regulated or is lightly regulated in most countries. Cryptocurrency trading can lead to large, immediate and permanent loss of financial value. You should have appropriate knowledge and experience before engaging in cryptocurrency trading.